Crypto Investment Tips: An Effective Approach to Growing Your Portfolio

Investing in cryptocurrencies can be highly rewarding, but it also comes with significant risks. To navigate this volatile market successfully, adopting an effective approach is essential. By staying informed and strategic, you can improve your chances of achieving consistent returns.

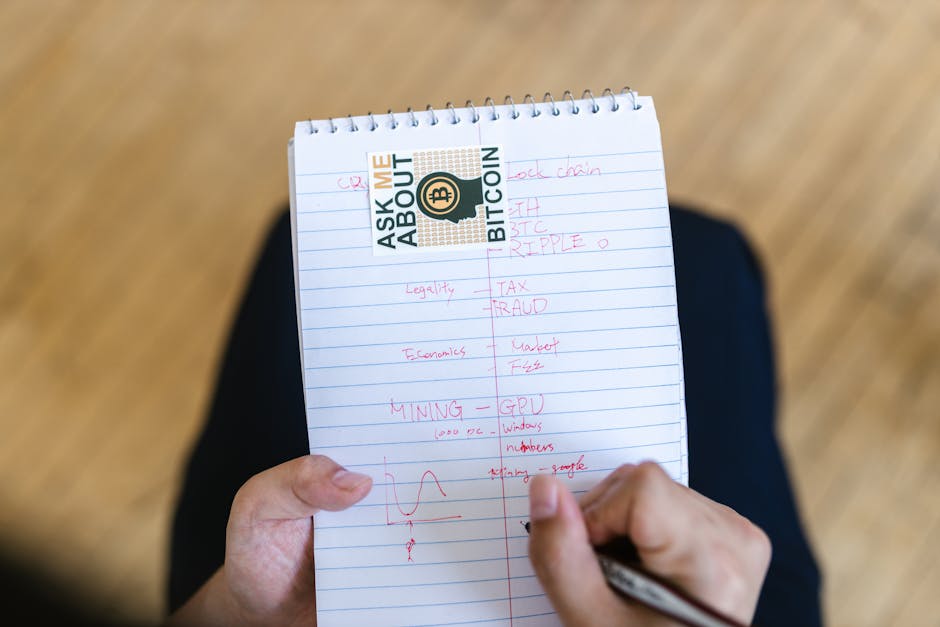

Understanding the Market Dynamics

Before diving into crypto investments, it’s crucial to understand market trends and the factors that influence price movements. Familiarize yourself with technical analysis and news sources to make informed decisions.

Diversify Your Portfolio

One of the most basic crypto investment tips is diversification. Don’t put all your funds into a single asset; instead, spread your investments across various cryptocurrencies to reduce risk.

Set Clear Investment Goals

Define your investment objectives—are you looking for short-term gains or long-term growth? Establishing clear goals helps shape your effective approach and guides your trading strategies.

Practice Risk Management

Crypto markets are volatile, so managing risk is vital. Use stop-loss orders and only invest what you can afford to lose. An effective risk management strategy can protect your investments from severe downturns.

Stay Educated and Updated

The cryptocurrency space evolves rapidly. Stay updated with latest news and educational resources to refine your investment approach continually. Knowledge is power in crypto investing.

By applying these crypto investment tips and maintaining a disciplined approach, you can enhance your chances of success in this exciting market.