Understanding Machine Learning and Deep Learning in Credit Risk Assessment

In today's financial landscape, accurately assessing credit risk is more critical than ever. Modern approaches leverage advanced techniques like machine learning in credit risk assessment and deep learning to improve prediction accuracy and automate decision-making.

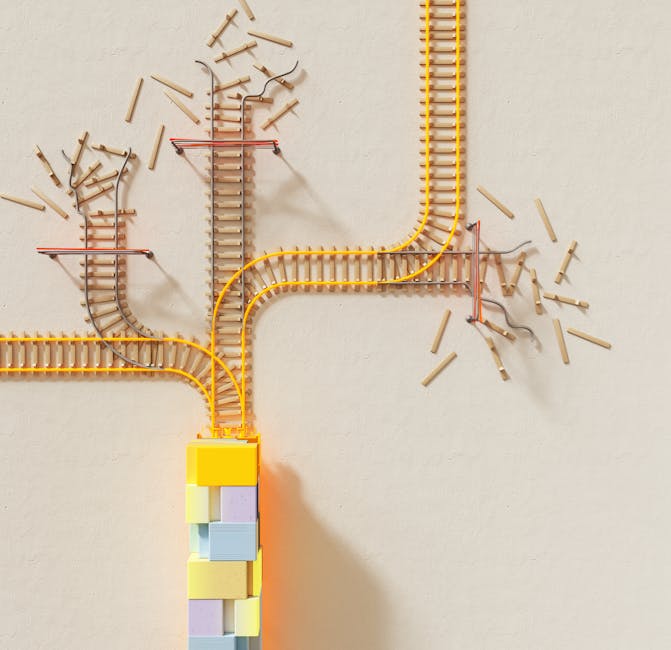

Machine learning algorithms analyze vast amounts of historical data to identify patterns associated with borrower behavior. These models, including decision trees, random forests, and gradient boosting machines, can quickly evaluate creditworthiness with high precision. The integration of machine learning techniques streamlines credit evaluation processes, reducing manual effort and human bias.

On the other hand, deep learning takes this further by employing neural networks that can learn complex, non-linear relationships. This capability is especially useful when handling unstructured data, such as text from financial reports or social media, providing richer insights into credit risk.

Real-world applications of these technologies include credit scoring systems, fraud detection, and personalized financial advice. Institutions utilizing deep learning models often experience improved predictive accuracy, enabling better decision-making and risk management.

As the financial industry continues to evolve, understanding the roles of machine learning and deep learning becomes essential for professionals aiming to innovate in credit risk assessment and elevate their institutions' capabilities.