Top 10 Cryptocurrency Investment Tips for Beginners

Introduction

Investing in cryptocurrencies can be highly profitable yet challenging. To help you succeed, here are the Top 10 cryptocurrency investment tips that every beginner should know.

Diversify Your Portfolio

Don't put all your eggs in one basket. Spreading your investments across different cryptocurrencies can reduce risks and maximize potential returns. Learn more about diversifying your crypto portfolio.

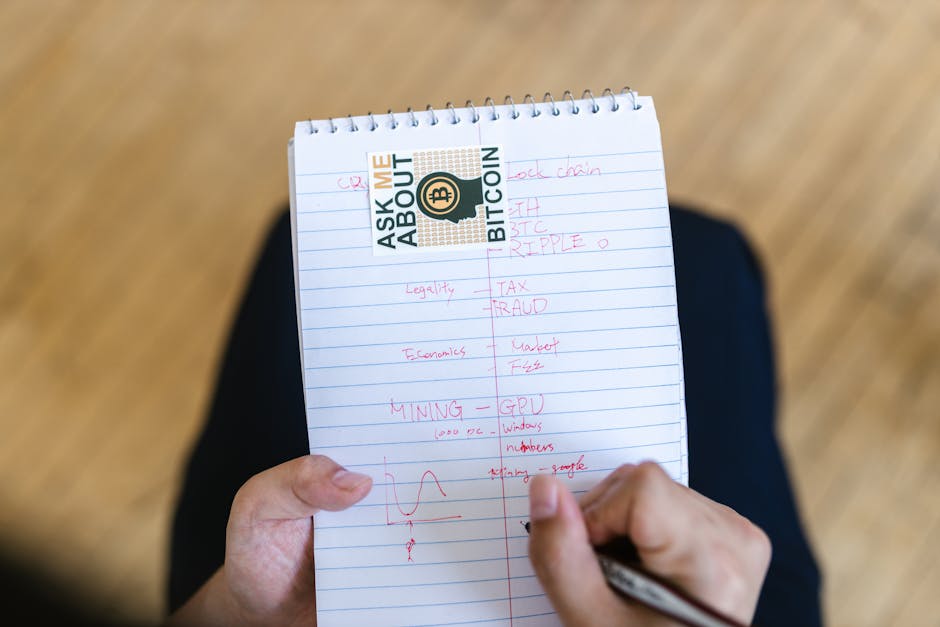

Research Before Investing

Always conduct thorough research on any cryptocurrency before investing. Understand the technology, team, and market trends. Read our guide on researching cryptocurrencies effectively.

Set Clear Investment Goals

Defining your financial goals helps in making informed decisions. Whether you're aiming for short-term gains or long-term growth, clarity is key.

Use Secure Wallets

Protect your digital assets by choosing reputable and secure wallets. Explore options in our cryptocurrency wallets guide.

Stay Updated with Market News

The crypto market is highly volatile. Staying informed with the latest news can help you make timely decisions. Follow trusted news sources and stay connected.

Practice Risk Management

Invest only what you can afford to lose and consider setting stop-loss orders. Managing risks is crucial in volatile markets.

Be Wary of FOMO

Fear of missing out can lead to impulsive decisions. Stick to your investment plan and avoid emotional trading.

Long-Term Perspective

While day trading can be tempting, a long-term approach often yields better results. Learn why holding is a valuable strategy in holding cryptocurrencies for the long term.

Continuous Education

The crypto space evolves rapidly. Keep learning through webinars, courses, and industry reports to stay ahead.

Conclusion

Implementing these Top 10 cryptocurrency investment tips can help you become a more confident investor. Remember, patience and knowledge are key to success in the crypto market.