How to Handle Unexpected Tax Bills from Your Crypto Gains

Understanding Unexpected Tax Bills from Crypto Gains

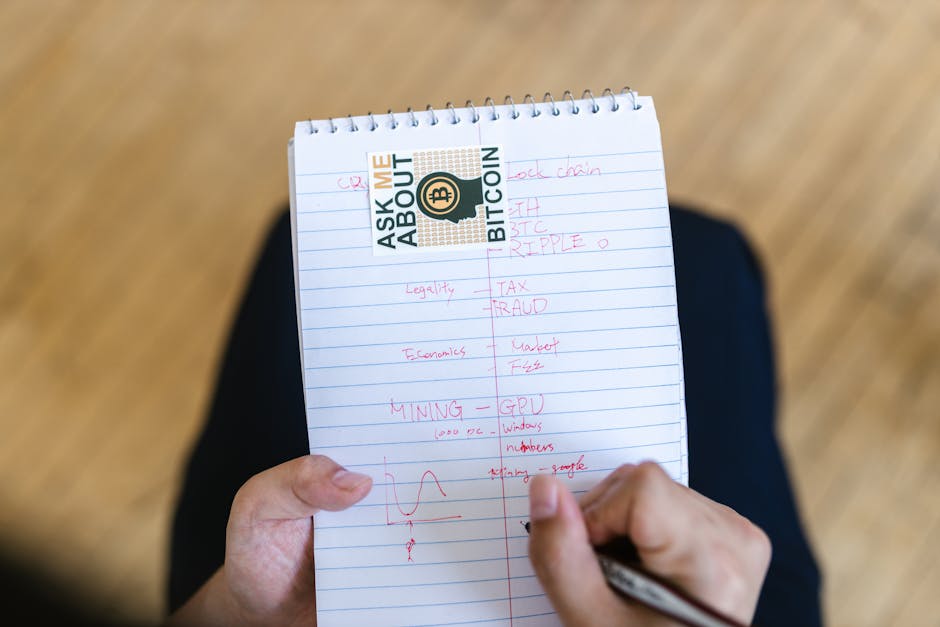

Many cryptocurrency investors are caught off guard when they receive an unexpected tax bill after realizing capital gains. Cryptocurrency trading can be highly profitable, but it also complicates tax reporting.

Why Do Unexpected Tax Bills Happen?

Unexpected charges often occur due to miscalculations of taxable events or lack of proper record-keeping. It’s essential to have a clear understanding of crypto taxation rules to avoid surprises come tax season.

How to Prepare for Tax Season

- Use reliable crypto tracking software to monitor your transactions accurately.

- Keep detailed records of all trades, transfers, and conversions.

- Consult with a crypto tax professional for personalized advice.

Managing an Unexpected Tax Bill

If you find yourself with an unforeseen tax liability, consider options such as setting up a payment plan or seeking guidance from a financial advisor. Remember, ignoring the bill can lead to penalties and interest accruals.

Conclusion

Staying proactive about your cryptocurrency taxes can prevent unexpected bills. Educate yourself on the latest regulations and leverage tools to ensure accurate reporting. For more information, visit our guide on cryptocurrency tax management.

How-to-legally-minimize-unexpected-tax-liabilities-this-year--

Cryptocurrency-investment-mistakes-that-could-expose-you-to-audits--

NFT-rising-trends-that-could-boost-your-portfolio-unexpectedly--

Top-

secret-strategies-from-tax-experts-to-save-thousands