Exploring the Impact of Blockchain on Financial Markets

Understanding Blockchain Technology

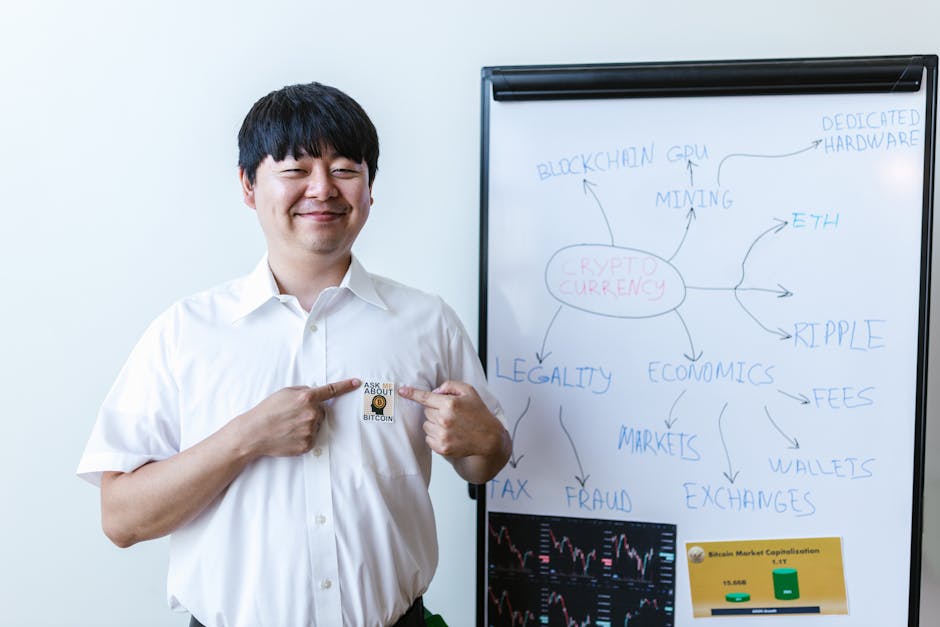

Blockchain technology is a decentralized digital ledger that records transactions across many computers. Its fundamental features include transparency, immutability, and security, making it a revolutionary tool in many industries, especially in finance. To learn more about blockchain fundamentals, visit our blockchain fundamentals page.

The Influence of Blockchain on Financial Markets

Over the past few years, blockchain impact on financial markets has become increasingly significant. Financial institutions are adopting blockchain to enhance processes such as settlement, clearing, and record-keeping, leading to faster and more secure transactions.

For example, cryptocurrency trading is one of the most obvious applications, where blockchain provides a transparent and tamper-proof platform for digital currencies like Bitcoin and Ethereum.

Benefits of Blockchain in Finance

Implementing blockchain technology offers numerous benefits, including increased transparency, reduced fraud, and lower transaction costs. These improvements are transforming traditional banking and investment practices. To explore how blockchain benefits financial services, check out our financial benefits of blockchain page.

Challenges and Future Outlook

Despite its advantages, blockchain adoption in finance faces challenges such as regulatory issues, scalability concerns, and technological complexity. Nonetheless, ongoing innovations and regulatory frameworks are likely to foster broader implementation in the coming years. For a detailed discussion on the future of blockchain in finance, visit our future of blockchain in finance section.